Have you ever come across a friend, relative, or a family member of yours who suffered huge financial losses after failing to run a successful business? Unfortunately, I happen to know some people who put their hearts and money into their business ideas, but because of their poorly advised financial decisions, not only they lost their money, some of them also lost their status in society. And to make matters worse, some are currently drowned in inescapable trenches of loans.

Let’s take Ccoronavirus as an example. Many young employees who are in the age bracket of 24 to 29 years old are struggling to cover their necessary expenses (rent, utility bills, food, and health) because they never thought about accumulating savings to survive through today’s economic crises. Moreover, many are psychologically refusing to abandon their pre-Coronavirus lifestyle that included dining out, going to movies, shopping, camping trips, etc. because of poorly advised income spending habits.

The problem is that many of us think that we are invincible. For some reason, we convince ourselves that we will be fine, and that illusion prevents us from taking realistic financial measures. Unfortunately, in Pakistan, we become easily influenced by others (e.g. friends or elders that we look up to) who sometimes fail to educate us on the right way to spend, earn, and save money. We have become a nation of “short-cuts” that is always looking for the easiest and quickest way to make money. Therefore cyber, phone and investment scams are thriving because these scams prey on our impatience.

Fortunately, the current government of Pakistan, and more specifically, the State Bank of Pakistan, has taken an unparalleled initiative to educate our youth on financial literacy. Our government realises the untapped potential of bright young ideas that can turn into big businesses, strengthening the economy of Pakistan. They have launched a mobile game called “PomPak” in partnership with Asia’s leading ed-tech company, Knowledge Platform, that also has more than more than 700 schools registered in Pakistan.

At first, I thought that PomPak will just be one of those games that teaches us the simple math of profit and loss. I thought that because I graduated from Carnegie Mellon University, where I studied with and from the word’s most talented pool of students and faculty, the last thing I would need is an application telling me how to make money. How wrong I was!

PomPak is a short phrase for “Pomegranate Pakistan”. It is a story of a family of four people (parents and their two children) who own a small farm in their village. They begin by planting pomegranate trees and selling the fruit in the city. To expand this business, the application begins with educating the user about making a family budget, identifying necessary and unnecessary expenses, accumulating savings. The user can plant trees or build farms, factories, purchase machinery, etc. as they take make the right financial decisions.

As I continued playing this game, I watched a series of short, interactive videos and assessments embedded within PomPak. I learned about making financial projections over the n number of years to estimate profits and costs of running my business, the difference between loan and equity-based financing to start a business, basic and compound interests to calculate loan repayments, the difference between conventional and Islamic financing, the pros and cons of transitioning the business to e-commerce verse brick-and-mortar model, and many other important factors that I must consider if I were to ever start my own business.

Today, we live in the age of start-up businesses. As technology is becoming more and more accessible, we are transitioning from a diploma-based to a skill-based education. You can earn more than a graduate at Google if you are good at programming and solving complex problems. Therefore, the rise of skill-based education is creating more and more business ideas that were never thought of before. To shape those ideas into reality, we must be able to make the right financial decisions. Otherwise, either our businesses won’t take off or they would fail to sustain themselves after a while.

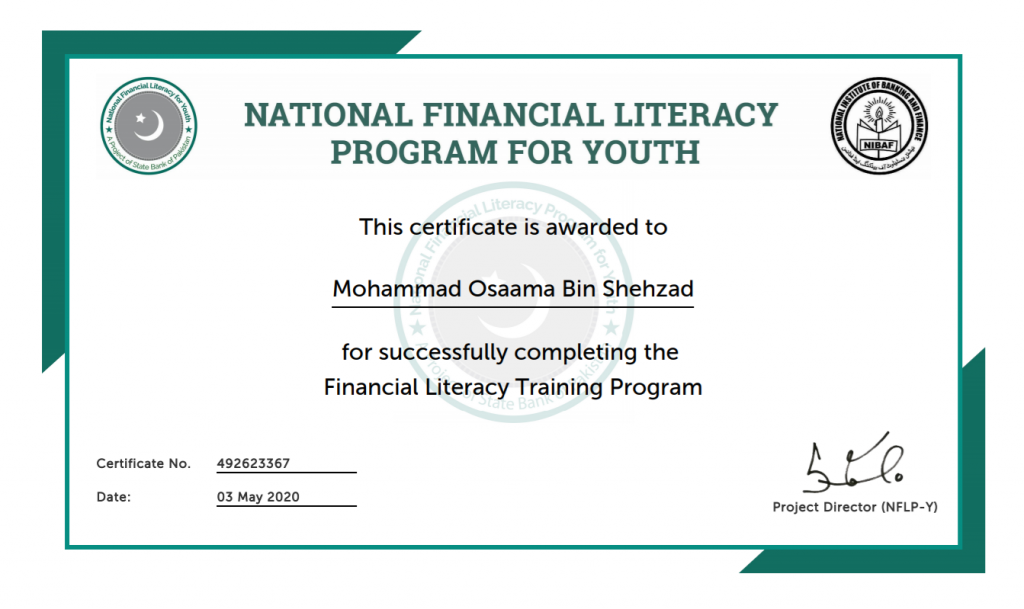

Today, I am delighted to share that I have successfully completed the State Bank of Pakistan’s financial literacy program by playing PomPak. I also received a certificate from the National Institute of Banking and Finance, NIBAF, which I am sharing with you all. I strongly advise that you play this game and ask the children in your family to try it out, so they can also become experts in financial matters.

PomPak is available for download on both android and iOS phones.