Online Certifications in

ISLAMIC FINANCE

(E-FIBO and E-IBBO)

The National Institute of Banking and Finance Pakistan (NIBAF PK) and Knowledge Platform

bring you three industry-accredited online certifications in Islamic Finance.

A subsidiary of the central bank of the country, State Bank of Pakistan, NIBAF Pakistan is a leading institute for the training of central and commercial bankers, micro and rural finance providers and management professionals of the country.

WHAT IS ISLAMIC FINANCE?

Islamic Finance is a financial system that functions according to Islamic law, or Shariah. It is based on the principles that support moral, fair, and socially conscious business operations.

WHO ARE THESE COURSES FOR?

Bankers and Finance Professionals

Enhance your expertise in Islamic banking and Shariah-compliant products.

Investors

Explore Shariah-compliant investment and wealth management strategies.

Legal and Compliance Officers

Navigate the regulatory landscape of Islamic finance.

Students and Academics

Gain specialized knowledge in Islamic finance and ethical banking.

Business Owners

Learn ethical, interest-free financing solutions for business growth.

Learners

Anyone seeking ethical alternatives to conventional banking.

Why should corporations and businesses follow Islamic finance?

Shariah Compliance

All Islamic finance practices are strictly aligned with Shariah law. Under the guidance of esteemed scholars, each transaction is carefully reviewed to ensure adherence to religious principles, supporting a finance model that is ethically sound and faith-based.

Regulatory Mandate

The 26th Constitutional Amendment in Pakistan (2024) updates Article 38(f), mandating the nation’s financial system to transition fully to an interest-free (riba-free) model by January 1, 2028. This shift requires all banking institutions to adopt Islamic finance principles nationwide.

Inclusive Finance

Islamic finance also offers essential services to individuals who refrain from conventional banking for religious reasons. By catering to these needs, it promotes financial inclusion, allowing more people to access banking services that align with their beliefs.

Ethical and Sustainable Alternative

Islamic finance and banking provide a socially responsible and ethical alternative to conventional systems. Through risk-sharing, asset-backed transactions, and ethical investment principles, Islamic finance promotes practices that support sustainable development and a more balanced economic framework.

Global Growth and Economic Stability

Islamic finance is expanding as a resilient, socially responsible model. By backing transactions with tangible assets, it reduces risk and fosters stability. This ethical model promotes economic stability , supports sustainable development, and advances global financial stability.

INDUSTRY-ACCREDITED CERTIFICATIONS

The National Institute of Banking and Finance Pakistan provides certifications for these online courses and treats them as

- The equivalent to the corresponding face-to-face workshops.

- Meeting the State Bank of Pakistan’s requirements for the applicable courses.

Fundamentals of Islamic Banking Operations (E-FIBO)

This online program provides a comprehensive introduction to Islamic banking operations. It covers Shariah-compliant products, the SBP regulatory framework, Islamic laws of contracts, and various related topics essential for understanding Islamic finance.

Islamic Banking Branch Operations (E-IBBO)

Designed for operational staff, this course covers Islamic economic guidelines, basic principles, and philosophy. It addresses Shariah concepts, Islamic banking deposit categories, and pool management essentials.

Fundamentals of Islamic Banking Operations Top-up (E-FIBO Top-up)

Intended for those who have completed the IBBO certification from NIBAF, this program offers additional learning outcomes required to attain FIBO, covering areas not included in the IBBO course.

MODULE OBJECTS

LESSON OBJECTS

Concept Video

Case Study

Quiz

Games

Glossary

Final Assessment

Pricing Model

Access top-tier and certified content at competitive rates that offer exceptional value, making high-quality learning affordable for everyone.

PRICING (PKR)

Learners

Online Certification

No. of Licenses

E-FIBO/License

E-IBBO/License

E-FIBO Top-up/License

1 - 100

15,000

9,000

6,000

101 - 300

13,500

8,100

5,400

301 - 600

12,150

7,290

4,860

601+

10,935

6,561

4,374

Payment will be on a step-ladder basis.

Scenario

- If an organization buys 150 licenses for E-FIBO in one go, the price will be PKR 13,500/license, and;

- If an organization buys 150 licenses for E-FIBO in batches, i.e., 100 licenses first and then 50 licenses, the price will be PKR 15,000/license for the first 100 learners PLUS PKR 13,500/license for the next 50 learners

*Exclusive of all taxes

We also license the courses for access through a client’s internal learning management system, with certification provided by NIBAF Pakistan through tests on the NIBAF Pakistan learning management system.

About Islamic Finance Courses

Endorsements

Discover how Islamic Finance not only streamlines your financial journey but empowers you to achieve true Shariah-compliant growth

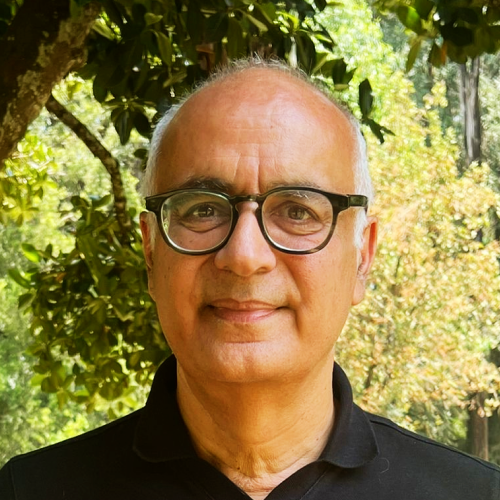

"Creating this program has been incredibly fulfilling. We developed a user-friendly platform with engaging videos, case studies, quizzes, and assessments, designed to make certifications accessible and efficient. Leveraging technology, we’ve accelerated the qualification process while ensuring that all courses meet State Bank of Pakistan’s standards for Shariah compliance. Beyond compliance, we’ve prioritized real-world applications, enabling learners to immediately apply these concepts in their careers. This approach equips a new generation of professionals with a comprehensive, industry-accredited certification in Islamic finance, empowering them to lead in Shariah-compliant finance practices across the industry."

Mahboob Mehmood

“During my review, I found a video lecture on hoarding (ihtikaar) followed by a highly engaging game that addressed an important issue. Typically, this topic is not given much emphasis by educators, but I believe it is crucial, and every banker should be aware of these facts. I commend the Knowledge Platform team for designing the content in a way that delivers the message effectively and tests the knowledge in an engaging and enjoyable manner.”

Mufti Najeeb Ahmad Khan

Contact Us

Contact us for more information about Islamic Finance Banking Courses. Our team is always available to provide assistance.

Email Us

elearning@knowledgeplatform.com nibaf.elearning@sbp.org.pk